This new Virtual assistant resource commission is part of the procedure of providing an excellent Va mortgage. Right here we provide a Virtual assistant capital fee chart so if you have been in the procedure of applying for one among them mortgage promises, there will be wise off what you may you desire to expend. There are lots of exemptions solution professionals and you may experts who don’t need to pay the fee and differing pricing apply with regards to the sort of financing. Because you help make your computations to suit your Virtual assistant loan buying a property, or re-finance your own financial, include so it commission on your list of expenditures.

Va Loan Charges try something that you shell out via your closing costs, which cannot necessarily emerge from wallet (much more about one less than). That it fee does shell out to help with the fresh Va Loan program, and this assures and guarantees finance to own army provider some body, experts and you can enduring partners. That is important because the brand new Virtual assistant Home loan system might have been in control getting providing americash loans Moody over 25 billion pros and you can active obligation armed pushes staff as it began, also it aided 1.2 million heroes during the 2020 by yourself.

This is the good news/bad news: you may be necessary to spend the money for commission, nevertheless helps maintain the Va Financing system alive getting pros also productive obligation army personnel.

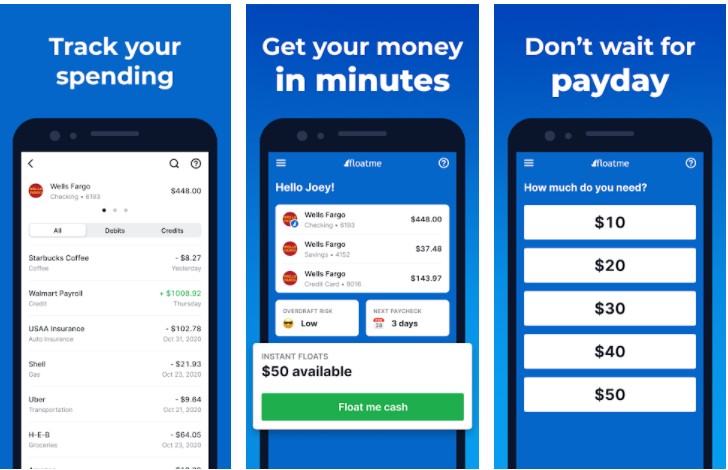

The only-date payment kicks within the at various other membership for various fund considering of the Virtual assistant. For individuals who thought the fresh You.S. Department from Veterans Circumstances merely given one kind of financing, you will want to understand the entire variety of options that can help you order a property and you may refinance the financial once you’ve got your property for a while.

Purchase

After you buy property making use of the Va financing program, the latest financial support fee ranges ranging from 2.step 3 step 3.six % of the loan amount. If you are looking at the house regarding $three hundred,100 range, which means your own Virtual assistant funding percentage could be ranging from $6,900 and you can $ten,800.

Va IRRRL

This might be a refinance loan you are able to to attenuate the new interest you have to pay on your own financial. One generally speaking becomes a choice if rates of interest try shedding, but when you can properly re-finance it will lower your month-to-month fee in the short term, Plus full mortgage repayments ultimately.

It is also known as a streamline re-finance by the Va. It needs much less documents, fewer criteria and less fret full. It is extremely a simple re-finance and can usually get in put in about thirty days. Consequently, brand new Virtual assistant financing funding fee because of it process is quite a beneficial piece lower than any of the other money regarding Va system (come across graph less than).

Va Cash out Refinance

This can be some other re-finance option regarding Virtual assistant, however, allowing you re-finance the financial and turn the latest security you’ve designed in the property on the dollars. You need to use so it bucks to fix your house, upgrade they, establish energy conserving points, realize their knowledge or take proper care of emergencies (such as for instance, medical debts).

Because this is perhaps not sleek and also like a frequent re-finance using the laws and regulations and you may files, you’ll spend a higher funding percentage than many other financing possibilities (similar to might buy an everyday Virtual assistant Pick Mortgage.

This 1 try open to Va Loan holders and you may antique financial people who be eligible for an effective Va mortgage but may have skipped they initially out. One to capability to convert a normal loan into the good Va financial, and now have cash back, helps make this an incredibly glamorous choice underneath the correct facts.