This new California Housing Money Department (CalHFA) is actually established in 1975. CalHFA brings a mortgage and you will downpayment recommendations programs having low so you’re able to modest income Californians.

If you take aside a qualified CalHFA first-mortgage mortgage, you are eligible for extra CalHFA downpayment assistance:

- MyHome Recommendations Program, which is combined with No Attract System (ZIP)

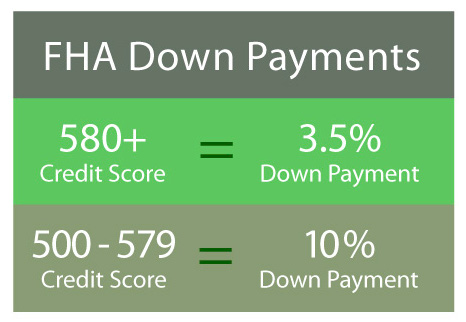

- Antique, FHA, and you can Virtual assistant Applications

- College and Teacher Worker Guidance Program (previously More Borrowing Professor Family Purchase System)

- Cal-EEM + Grant High efficiency Mortgage having Offer

- MCC Financial Credit Certification Taxation Program

UPDATES: On switch to help far more Californians qualify for CalHFA conventional mortgages. In thirty-five areas, he has got improved the maximum qualifying earnings of 120% to help you 140% of your County’s average earnings. Eg, to possess a four-individual home from inside the Hillcrest Condition, the amount of money limitation has grown of $91,a hundred so you’re able to $106,250.

- First-Time Household Buyer according to CalHFA, a primary-date domestic visitors are somebody who has perhaps not possessed their house during the last 3 years. When you have previously owned a house, however, ended up selling they no less than 36 months back, your meet the requirements since the a primary-day home customer.

- Reside Since Number one Residence CalHFA requires the debtor(s) so you can take the home for your name of your own financing, unless you sometimes promote otherwise refinance out-of an effective CalHFA system.

- Low so you’re able to Moderate Income Earnings restrictions vary by the county, system installment loan Delta MO, and you may household dimensions. He’s up-to-date frequently, therefore check the CalHFA money and you will sales pricing restrictions web page getting current amounts. Active , the cash restrict to possess a four-people domestic inside the North park are $106,250 for a normal financing, and you may $102,450 for an enthusiastic FHA mortgage. Productive , the funds limitation having a four-person home inside San diego try $91,one hundred for good Va mortgage. CalHFA doesn’t number full domestic earnings. Truly the only earnings measured is actually for brand new consumers with the loan.

- Possessions Conversion Speed Constraints Transformation price restrictions is actually current daily on CalHFA income and conversion costs restrictions web page. Active , the sales rate maximum during the Hillcrest County try $600,one hundred thousand. Certain apps ounts.

Such advance payment recommendations programs offer money that may wade into buyer settlement costs, such as the advance payment, upfront financial insurance costs, and you may financial/title/escrow charges. You may hear about client closing costs.

MyHome Guidelines Program, In addition to Zip

MyHome money can be used for the deposit and you can/otherwise settlement costs. MyHome is actually a great deferred, simple-interest loan (hushed second) comparable to step 3% of the sales rate otherwise appraised well worth, whatever are shorter. The easy appeal towards MyHome loan is 2.5%. The most Obligations-to-Income qualifying ratio getting MyHome is actually 45%.

MyHome shall be in conjunction with all of the CalHFA first-mortgage software, including the CalHFA No Appeal Program (ZIP). When combined with CalPLUS loans and you may Zip, the interest rates are slightly highest, but Zip could help get a property without currency down.

CalPLUS FHA Loan MyHome and Zero

Whenever along side an effective CalPLUS FHA mortgage, Zip try downpayment direction in the form of a good deferred-payment ount. The pace increases that have a higher Zip loan. Read the CalHFA webpages to own most recent interest rates.

UPDATE: Active s commonly now promote a finite 203(k) solution. This may allow for a supplementary $thirty-five,000 borrowed to cover improvements and you can fixes contained in this half a year out-of purchase.

CalPLUS Traditional Mortgage MyHome and Zero

MyHome and Zero can also be used on CalPLUS Old-fashioned financing. The typical Zip 2nd financing was a no-attention, quiet 2nd financing to own step 3% or 4% of your first mortgage matter. The speed expands that have a high Zero mortgage. Read the CalHFA web site to possess current interest levels.